Overspent For The Holidays? Ways To Stretch The Budget Further

The holidays are fun and during this time, it’s easy to forget about your budget and splurge. Wondering how to stretch the budget further after you’ve had a holiday blowout?

The festivities can continue throughout the year with some careful planning. The more preparation you put in, the more you’ll be rewarded. Here are ways you can recover from overspending for the holidays.

Stop the guilt

Christmas came and went. You spent too much and you can’t go back. Stop feeling guilty!

Instead, channel your energy into writing down where you overspent. Take note of all the unaccounted costs and get it’s total — shipping fees, extended warranties, gift wrap, and checked baggage fees.

Learn from your budget mistakes. Set yourself a realistic goal of spending less next time.

‘No-spend’ month

Following the holiday season, it’s the perfect time to challenge yourself to a ‘no-spend’ month. Anything that isn’t necessities or bills (groceries or gas) gets put on the backburner until after the challenge.

It’s up to you how long the challenge goes. It’s recommended to be at least a month.

Holiday leftovers

Using what you have in your home can save you heaps. Start with holiday leftovers.

Check out online for recipe ideas on leftovers. It’ll be amazing what you can throw together without going to the supermarket.

Snowball effect

The snowball effect is a great approach for paying off multiple debts. It emphasises the power of motivation and gives off a sense of accomplishment after paying off a debt.

For example, choose one credit card to pay extra while paying the minimum balances on the others. You then move onto the next card once you pay off the first debt. Continue until they’re all fully paid off.

Note: Start with the card with the highest interest rate or the one with smallest debt balance.

Earn some extra income

You can become a virtual assistant, take online surveys that pay cash, or become an Uber driver in your spare time.

Set new financial goals

Write down whatever you want to accomplish financially after the holidays. It can be building an emergency fund or paying off your credit cards.

Seeing exactly what you want to achieve will help you make it a priority.

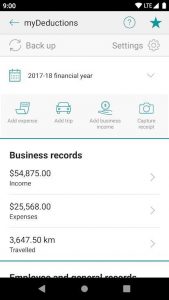

Where are you financially?

It’s important to look closely at your bank account to figure out where you are financially. Make sure you can at least pay your usual monthly bills, such as rent and utility.

If you can’t, you may need a loan to help you get back on track. With this approach, be sure to incorporate the repayments into a revised budget.

Emergency loans in Australia

Do you need a fast and small fund?

Cigno Loans can help with their emergency loans, as well as bad credit loans — if you have a less than stellar credit history.

Once your application is approved, cash is moved into your bank account with repayments easily arranged.