Get The Most Back From Your Tax Return!

You’re entitled to claim deductions for some expenses when completing your tax return — most of which are work-related expenses.

Deductions you can claim

Work-related expenses

To claim a work-related deduction, you must have spent the money yourself and weren’t reimbursed. It must relate to earning your income and proven with a record.

You can only claim a deduction for the work-related portion if the expense was for both work and private purposes.

Note: Employees can claim work-related expenses in the financial year they are incurred.

You may be able to claim a deduction for expenses that directly relate to your work, including:

- clothing, laundry, and dry-cleaning expenses — a uniform needs to be unique and distinctive to legitimately claim it’s cost.

- home office expenses — costs could include your phone, computer, or other electronic devices, and running costs (e.g. internet service).

- self-education expenses — the study should be related to your current job — claim expenses such as course fees, student union fees, textbooks, professional journals, and stationery.

- tools, equipment and other assets — protective gear, sunglasses, hats, office equipment, safety equipment, and technical instruments.

- vehicle and travel expenses — if you work in different locations or you use your car for work.

Other deductions

- ATO interest (calculation and reporting)

- interest charged by the ATO — imposed interest includes general interest charge (GIC), shortfall interest charge (SIC), and late payment interest.

- cost of managing tax affairs — includes buying tax reference material, tax return preparation courses, lodging your tax return through a registered tax agent, etc.

- gifts and donations — to organisations that are endorsed by the ATO as deductible gift recipients.

- interest, dividend, and other investment income deductions

- personal super contributions — if made during the year to a complying super fund or a retirement savings account (RSA).

- undeducted purchase price (UPP) of a foreign pension or annuity — the UPP is the amount you contributed towards the purchase price of your pension or annuity – your personal contributions.

See Occupation and industry specific guides to find out more about income, allowances, and deductions you can claim for work-related expenses.

Managing your deductions

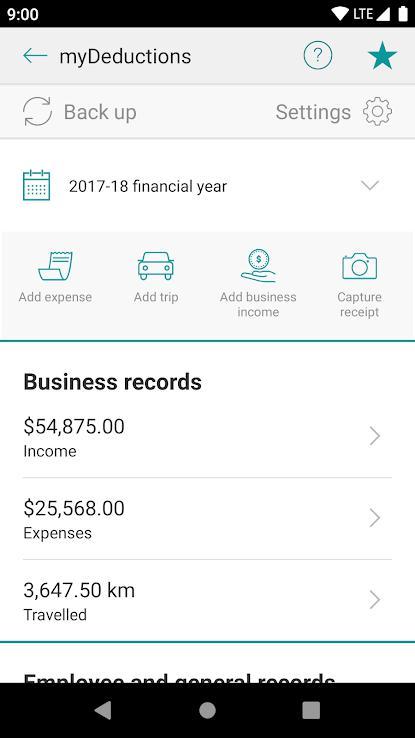

Keep your tax organised with the ATO app’s myDeductions tool.

Use myDeductions to keep records of your work, general expenses, income, and deductions to make lodging your tax return faster and easier.

Download the ATO app then select the myDeductions icon.

Upload your completed records to the ATO from the myDeductions tool and pre-fill your myTax return. You can share your records directly (via email) if you use a registered tax agent.

Easy loans in Australia

If you need cash today for an urgent or unexpected expense, Cigno Loans can help with easy loans.

Cigno believes in a fair go and considers all applications — whether you’re working or on Centrelink!

Cigno offers a 24/7 online platform so you can apply anytime, anywhere, even on weekends!